Security

Holiday Crime Spike: Essential ATM Security Tips for the Festive Season

ATM thefts rise during the holidays. Discover key strategies to prevent ATM break-ins, safeguard cash, and keep your machines protected all season long.

November 12, 2025

‘Tis the Season to Stay Secure

The holiday season brings higher retail sales, travel, and, unfortunately, a spike in ATM break-ins. As cash circulation increases, criminals target unattended or lightly monitored machines. For ATM operators, this season calls for more than festive décor; it demands vigilance to safeguard both equipment and customer funds.

From smash-and-grabs to jackpotting attempts, ATMs are increasingly targeted during long weekends and holidays when monitoring may lapse. Understanding why this happens and implementing the right defenses can mean the difference between smooth seasonal operations and costly downtime.

Why ATMs Become Targets During the Holidays

Higher Cash Volumes

During the holiday shopping season, ATMs are stocked with higher cash loads to accommodate increased withdrawals. That makes them a prime target for thieves seeking quick, high-value gains.

Reduced Oversight and Staffing Gaps

Holidays often mean reduced staffing at retail locations and financial institutions. This limited supervision gives criminals more time to act, especially at night or on weekends.

Increased Distractions

Busy stores, crowded parking lots, and dimly lit areas make it easier for thieves to blend in unnoticed during high-traffic periods.

Predictable Cash Refill Schedules

Consistent cash-loading schedules can be exploited. Criminals watch for these patterns and plan attacks accordingly, especially around holidays.

Understanding the Common Holiday-Season Threats

Physical Break-Ins (Smash-and-Grab)

These involve brute force, prying open the vault, dragging the machine away with vehicles, or using specialized tools. Portable ATMs in convenience stores and outdoor kiosks are especially vulnerable.

Skimming and Card Fraud

Holiday crowds make it easier for criminals to install card-skimming devices. Overlays on card readers or hidden pinhole cameras can capture sensitive card data during high transaction peaks.

Jackpotting Attacks

This malware-based attack manipulates the dispenser to release cash. Jackpotting often spikes during long holidays when immediate technical inspection may be delayed.

Vandalism and Tampering

Acts like spray-painting, keypad tampering, and camera obstruction may not involve theft but disrupt service and erode customer trust.

Emerging Tactics

Some criminals combine physical and cyber methods, breaching USB ports, deploying malware, or exploiting communication lines. Staying updated through industry sources like ATMIA is critical.

How to Assess Your ATM Risk Profile

Before implementing security measures, evaluate the specific risks at your ATM’s location:

- Location Audit:Check if the ATM is in an isolated or poorly lit area, or if nearby activity could obscure suspicious behavior.

- Historical Activity Review:Look at past incidents at this site, including tampering attempts, vandalism, or service interruptions during previous holidays.

- Cash Load Considerations: Take note of how much cash the machine holds, especially if higher amounts are loaded during peak holiday periods.

- Maintenance Timing: Review whether inspections, refills, or servicing coincide with busy holiday periods, when response times may be slower.

- Connectivity and Monitoring: Confirm that the ATM’s alarms, cameras, and real-time alerts are functioning and tested, so any unusual activity can be detected immediately.

By evaluating these factors for each individual location, operators can focus security upgrades and preventive measures where they’re most needed to protect both the machine and customer funds.

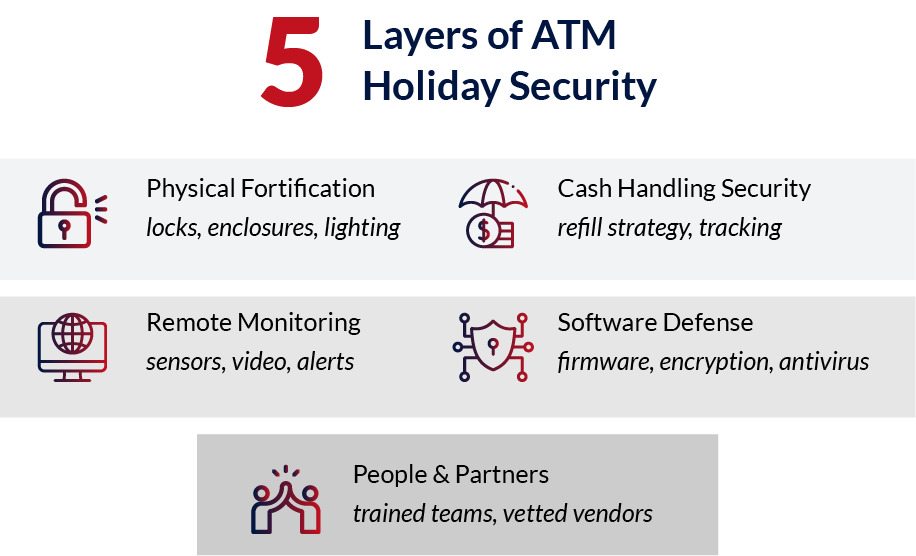

Preventive Security Measures for the Holiday Period

Reinforce Physical Protection

- Anchor units with heavy-duty bolts or enclosures.

- Upgrade locks and safes to UL-rated or time-delay versions resistant to drilling.

- Add reinforced shells or bollards to deter vehicle-based attacks.

- Maintain proper lighting and motion sensors around every ATM site.

Optimize Cash Management

- Adjust refill schedules and randomize timing.

- Reduce maximum cash loads where possible.

- Coordinate with armored carriers or vault cash providers to avoid predictable routines.

Increase Remote Monitoring & Alerts

- Enable 24/7 remote diagnostics and real-time alerts.

- Integrate surveillance cameras covering the ATM and the surrounding area.

- Consider outsourcing to professional monitoring centers during off-hours.

Strengthen Software & Network Security

- Keep firmware and OS updated against jackpotting vulnerabilities.

- Encrypt all communication channels between ATMs and processors.

- Deploy antivirus and endpoint protection software.

- Rotate credentials and restrict access to authorized personnel only.

Train Employees and Vendors

- Train teams to recognize tampering or hidden skimming devices.

- Verify IDs of all technicians and vendors performing service calls.

- Maintain clear schedules and accountability for each ATM location.

Responding to Incidents Quickly and Effectively

Even with prevention, no network is immune. A strong response plan minimizes losses and downtime.

Immediate Action Steps

- Shut down affected ATMs remotely when suspicious activity is detected.

- Notify law enforcement and armored carriers immediately.

- Preserve camera footage for investigation.

Communication Protocols

- Inform your processing company and maintenance partners.

- Alert nearby businesses if multiple ATMs share the area.

- Maintain transparency with customers if service is interrupted.

Post-Incident Review

- Investigate attack methods and points of entry.

- Reinforce similar units across your network.

- Update your risk profile and monitoring procedures.

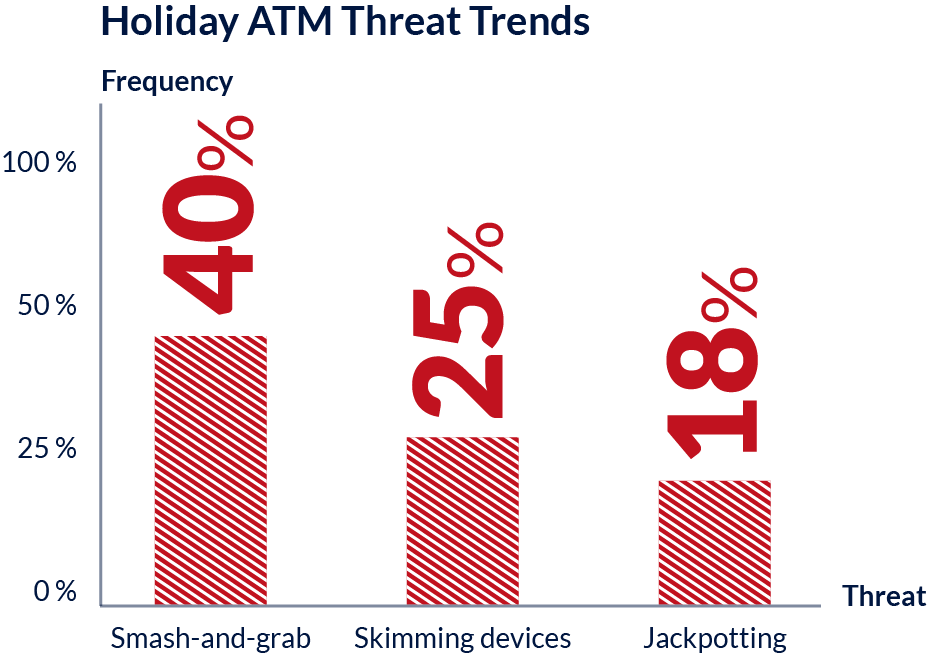

Lessons From Past Holiday Incidents

Data shows a noticeable rise in ATM smash-and-grab attempts between Thanksgiving and New Year’s. Common risk factors include:

- ATMs in poorly lit or isolated areas

- Predictable cash refill routines

- Broken or missing surveillance coverage

Operators investing in door sensors, GPS trackers, and live monitoring recovered stolen units or identified suspects faster, proving proactive measures truly pay off.

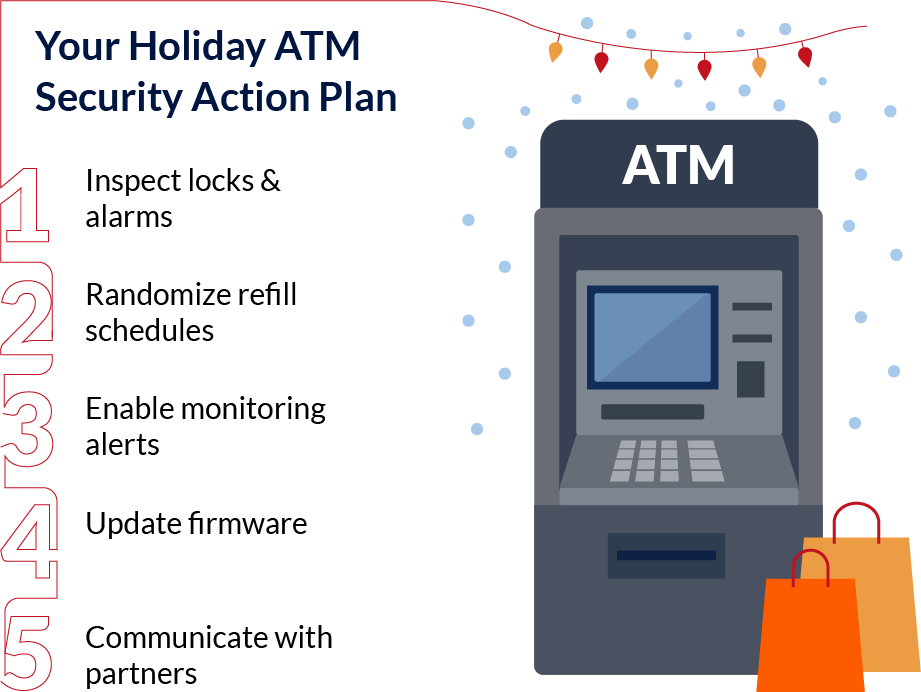

ATM Security Checklist for the Holiday Season

- Inspect locks, alarms, and vaults before the holiday rush

- Verify the lighting and visibility of the ATM

- Randomize cash refill and maintenance schedules

- Confirm firmware and antivirus updates

- Test real-time monitoring and alert systems

- Communicate with all vendors and partners

- Conduct quick visual inspections daily

Staying Ahead of Criminal Tactics

Security threats evolve constantly. Automation and AI-driven analytics now help operators detect abnormal behavior before it turns into theft. Investing in these systems protects both assets and brand trust year-round.

Conclusion: Secure ATMs Mean Secure Business

The holidays should be about celebration, not emergency repairs. By understanding why ATM break-ins spike during the festive season and reinforcing both physical and digital defenses, operators can safeguard networks, protect cash flow, and maintain customer confidence.

Stay proactive. Stay protected.

Learn more about ATM Link’s security solutionsand secure your machines before the holiday rush.

Frequently Asked Questions

1. Why do ATM break-ins increase during the holiday season?

ATMs carry higher cash volumes, experience less staff monitoring, and are located in crowded or dimly lit areas, all creating opportunities for theft.

2. What preventive measures can ATM operators take during holidays?

Reinforce locks, improve lighting, activate 24/7 monitoring, randomize refill schedules, and train staff to detect suspicious devices or tampering.

3. How does real-time monitoring help prevent ATM theft?

Monitoring systems detect abnormal behavior such as vault door openings, network disconnects, or power tampering instantly, allowing operators to respond before losses occur.

4. What should I do if an ATM break-in occurs?

Disable the machine remotely, contact authorities, preserve footage, alert service partners, and reassess vulnerabilities to prevent recurrence.

Included In This Story

ATM Link, Inc.

YOUR MAJOR RESOURCE FOR ATM PROCESSING, PRODUCTS, AND SERVICES

For over 26 years, ATM Link, Inc. has been helping retailers maximize profits with hassle-free ATM solutions. From transaction processing to full-service programs, quality ATMs, and expert support, we’ve got you covered nationwide. We prioritize customer satisfaction, security, and transparency, ensuring smooth operations and increased earnings

ChatGPT

ChatGPT Grok

Grok Perplexity

Perplexity Claude

Claude