Press Release

Analyze this! Detailed customer journey analytics at ATM from eKassir

How does the user go through the scenarios at ATMs, how fast? Where are the bottlenecks and friction points? You can easily get the answers on these questions about web-sites and mobile apps using Google Analytics. But the same analytics of customer journeys at ATM was not available until today.

October 11, 2021

A new module of customer journey analytics - "eKassir ATM Customer journey analytics" is available now in ATMs' multivendor software"eKassir ATM Terminal". Now "ATM Terminal" becomes a unique solution which can not only transform an ATM into a fully digital communication channel, but also measure the efficiency of this communication.

Due to the trends toomnichannel banking and branch transformation ATMs got the same functionality as internet- and mobile banks: operations with the client's products and applications for the new ones, payments for services and of course advertising in ATM's UI!How does this new functionality affect the efficiency of ATM network usage and the customer experience? How does the user go through the scenarios, how fast? Where are the bottlenecks and friction points? You can easily get the answers on these questions about web-sites and mobile apps using for example Google Analytics. But the same analytics of customer journeys at ATMs was not available until today.

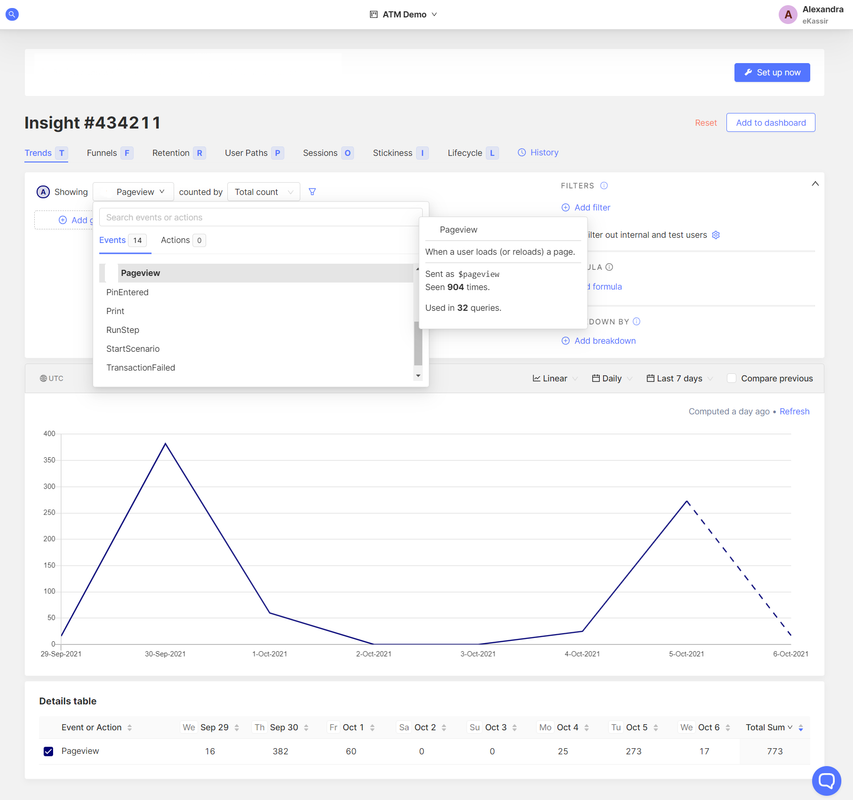

"eKassir ATM Customer journey analytics" module presents all data about customer interaction with the ATM in a user-friendly interface with visual graphics and dashboards. And in contrast with popular web-analytics services, eKassir's module operates in the bank's own infrastructure, which means that clients' data are not transferred to the third side and stay under control of the bank.

The module tracks all clients actions (clicks on buttons and menu items in ATM's UI, completion of the forms, operations with the client's products and so on) and lets analyze this data with the different reports:

- Trends.ATM usage trends: how are the customer scenarios varying over the time?

- Funnels - what percentage of clients reach the end of the scenario? What stages show the highest drop-off of the users?

- Paths- visualization of customer journey (at which menu item the client starts using the ATM, how they are flowing through, and when he stops using the ATM).

Also supported:

- Session recordings - it allows to record users navigating through your ATM or SSD and play back the individual sessions to watch how real customers use your device and which UI features cause struggles;

- A/B-testing - try several versions of UI or customer scenario and choose the one, which provides the highest conversion level;

- Cohorts analysis - divide clients into groups (cohorts) according to a certain characteristic and analyze how their interaction with ATMs varies over the time, for example, how often the clients logged in with the plastic cards and the ones with NFC use the certain functionality;

- Managing the functionality with Feature flags. Feature flags allow you to safely deploy and roll back new features for the limited groups of users: a fixed percentage of users,a set of users filtered based on their user profile or a combination of the two conditions.

"eKassir ATM Customer journey analytics" - this is the new stage in the development of omnichannel banking. Increase your sales and clients loyalty by making working decisions based on the real data.