News

Video banking a plus for bankers, consumers alike

March 31, 2017

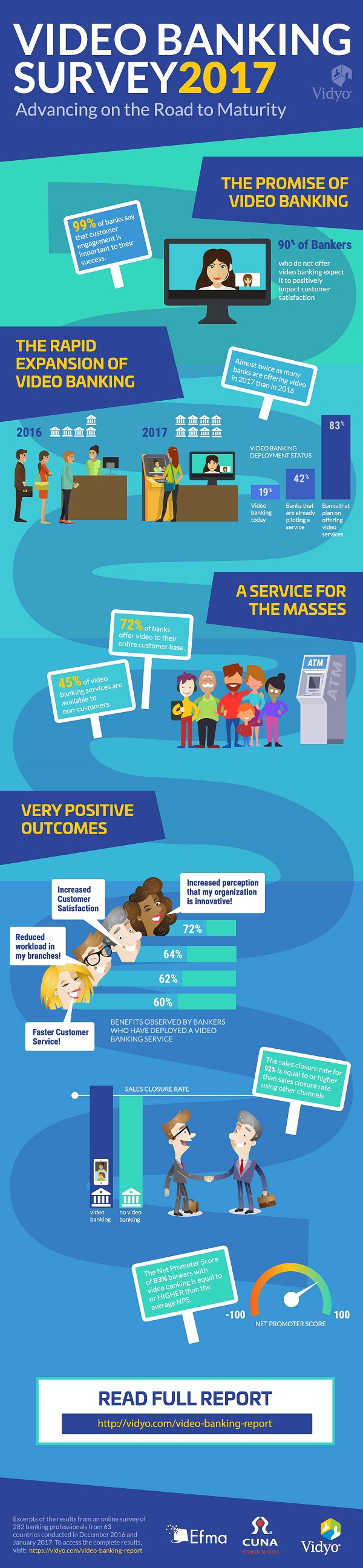

Vidyo, a provider of embedded video and video conferencing technology, Efma, an association of 3,300 retail financial services companies, and CUNA Strategic Services, a provider of technologies for credit unions, recently released the 2017 Video Banking Report.

The survey findings indicate that connecting via video is becoming increasingly accessible for customers of financial institutions, according to a press release. The report examines the adoption of mobile video banking around the world.

The survey findings indicate that connecting via video is becoming increasingly accessible for customers of financial institutions, according to a press release. The report examines the adoption of mobile video banking around the world.

Nearly 20 percent of FIs polled said they had deployed at least one form of video banking; more than 40 percent are piloting a video service; and more than 80 percent are planning to offer video banking in the future.

This compares with the previous year's results, which revealed that slightly more than 10 percent had deployed at least one form of video banking, and 30 percent were piloting a video service.

Other findings from the survey:

- 64 percent of respondents said video banking has increased customer satisfaction;

- 72 percent said video has increased the perception that their organization is innovative;

- 62 percent said video banking has decreased branch workload;

- 60 percent said video banking has enabled faster customer service.

"The survey results indicate that today's customers want to interact with their bank in a way that is both convenient to them but personal as well," Vincent Bastid, CEO of Efma, said in the release. "The fact the majority of bankers are looking to incorporate video banking in the future indicates that not only is it set to grow, but [also that] video banking is set to become a medium customers will become increasingly comfortable with and reliant upon."

Of survey participants whose institutions had not adopted video technologies, 60 percent said the inability to integrate it with their existing tech and workflows was a reason why they have not yet deployed such a solution.

This was one of five top concerns that accompany video banking, the survey found:

- high security;

- support of a variety of devices and operating systems;

- high-quality video;

- integration into existing workflows and applications;

- document sharing.

Data for the report, Video Banking Report 2017: Advancing on the Road to Maturity, was collected from 282 financial institution representatives across 63 countries from December through January.

ChatGPT

ChatGPT Grok

Grok Perplexity

Perplexity Claude

Claude