Payments

U.S. ATM Services Market Growth Forecast (2026–2035)

This article explores the ATM Services Market Growth Forecast for 2026–2035, highlighting global and U.S. market size, CAGR trends, and key drivers such as retail ATM deployment, managed services, modernization, and cash access demand for store owners.

January 19, 2026

Market Size, CAGR, and Key Growth Drivers for Retail Store Owners

Cashless payments are expanding rapidly across the United States, but access to cash remains essential for millions of consumers. Convenience stores, gas stations, supermarkets, hotels, and other high-traffic locations continue to rely on ATMs to support daily transactions and customer spending.

While ATM services market growth forecast periods vary slightly by research firm, this analysis focuses primarily on 2026–2035 trends to provide a consistent, long-term outlook for business and property owners.

Global ATM Services Market Overview

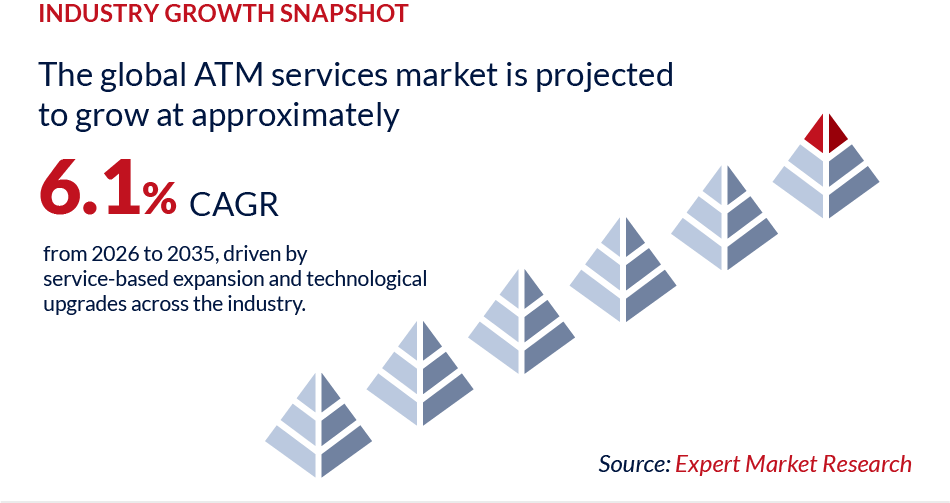

Expert Market Research projects the global ATM services market to grow steadily through the next decade, driven by service-based expansion and ongoing technological upgrades, as outlined in the ATM Services Market Growth Forecast.

Global Market Size and Growth Rate

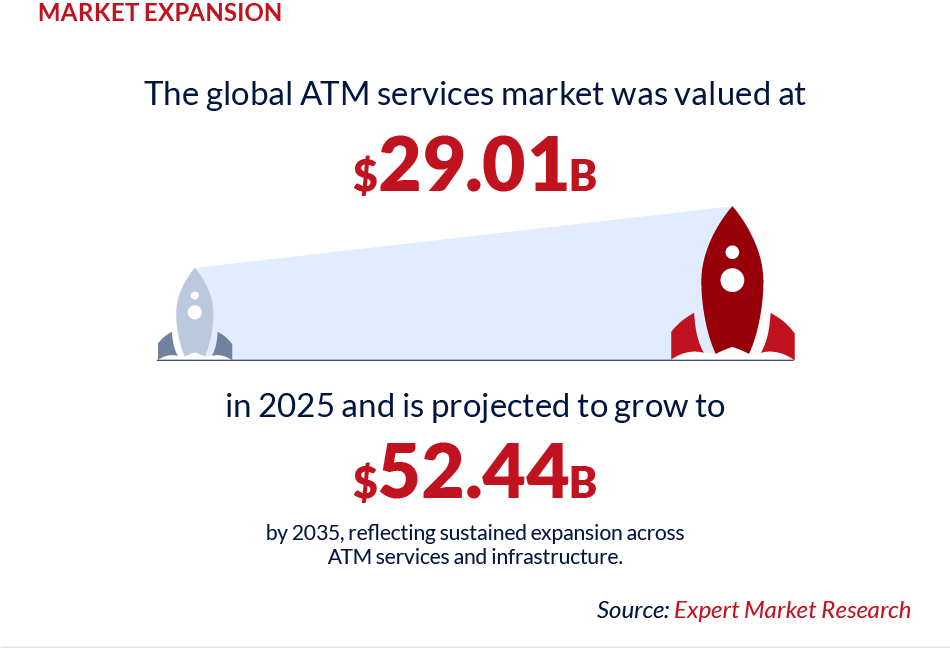

The global ATM services market was valued at approximately USD 29.01 billion in 2025 and is projected to reach USD 52.44 billion by 2035, representing a compound annual growth rate (CAGR) of approximately 6.10 percent from 2026 to 2035.

Source:Expert Market Research

This growth reflects a shift in how ATM services are delivered and monetized. Rather than focusing on increasing ATM counts, the industry is investing in higher-value services such as outsourcing, compliance management, software upgrades, and advanced cash optimization.

U.S. ATM Services Market Growth Outlook

U.S. Market Size and CAGR

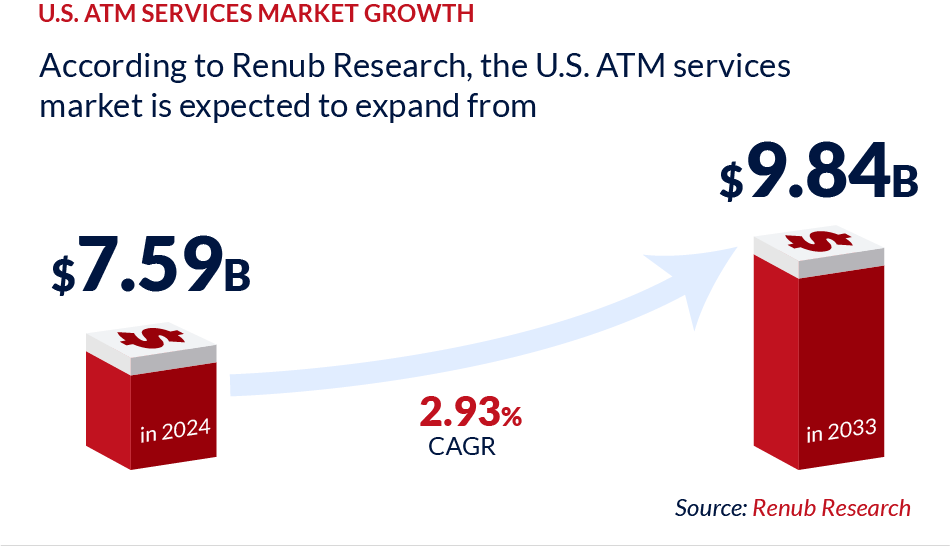

The United States remains one of the largest and most mature ATM markets globally. According to Renub Research, the U.S. ATM services market is projected to grow from USD 7.59 billion in 2024 to USD 9.84 billion by 2033, at a CAGR of approximately 2.93 percent.

Source:Renub Research

While growth is slower than in emerging markets, the U.S. market remains highly stable and predictable, supported by replacement cycles, managed services adoption, outsourcing, and continued consumer demand for convenient cash access.

Why ATM Services Continue to Grow Alongside Digital Payments

Continued Demand for Cash Access

Even as mobile wallets and digital payments gain popularity, cash remains widely used for small purchases, tipping, travel expenses, and budgeting. Retail and hospitality environments continue to see consistent cash usage.

Certain demographics, including underbanked and cash-preferred consumers, rely heavily on local ATMs as a primary point of financial access.

Shift From Quantity to Service Value

The global number of ATMs declined by approximately 2 percent in 2024, reaching around 2.9 million units worldwide. This decline does not signal the end of ATMs. Instead, it reflects a strategic transition toward fewer but more efficient, secure, and service-rich machines.

Key Market Drivers Shaping ATM Services Through 2035

1. Expansion of Off-Site ATMs in Retail and Hospitality

Off-site ATMs located in convenience stores, gas stations, supermarkets, hotels, bars, and entertainment venues remain a primary growth driver.

These locations benefit from:

- Consistent foot traffic

- Immediate cash usage by customers

- Increased impulse spending inside the store

For business owners, an ATM functions as both a customer convenience and a recurring revenue opportunity.

2. Growth of Managed ATM Services and Outsourcing

ATM outsourcing has become a core part of the industry. Banks and independent operators increasingly rely on third-party providers to manage:

- Installation and placement

- Cash replenishment

- Monitoring and maintenance

- Compliance and security

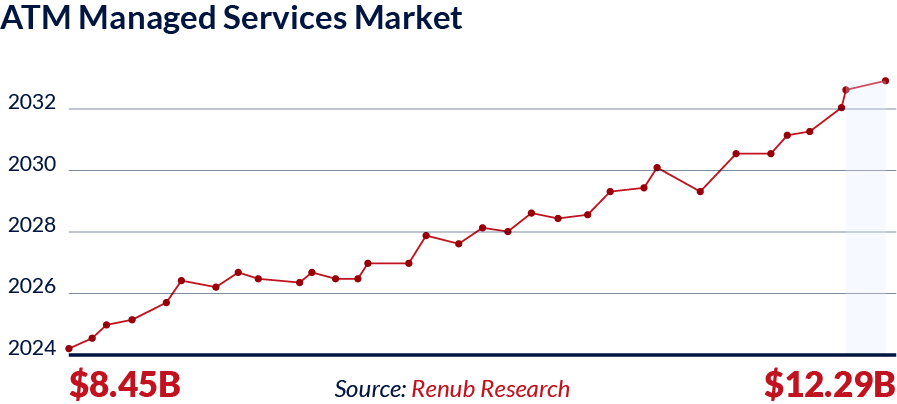

The global ATM managed services market is projected to grow from approximately USD 8.45 billion in 2024 to USD 12.29 billion by 2033, reflecting a CAGR of about 4.25 percent.

Source:Renub Research

The overall ATM outsourcing market was around $21.53 billion in 2024 and is expected to hit ~$34.58 billion by 2032 (6.1% CAGR).

Additionally, the broader ATM outsourcing market was valued at approximately USD 21.53 billion in 2024 and is expected to reach USD 34.58 billion by 2032, growing at a CAGR of around 6.1 percent.

Source:Data Bridge

For store owners, managed ATM models enable deployment with minimal operational responsibility and reduced risk.

3. ATM Network Partnerships Expanding Retail Access

ATM networks continue to expand through strategic retail partnerships.

In 2025, NCR Atleos announced the expansion of Allpoint Network services into thousands of 7‑Eleven locations through its partnership with FCTI. These locations now offer surcharge-free withdrawals and deposit-enabled ATMs.

Such partnerships highlight the growing role of retail locations as extensions of the broader banking infrastructure.

4. Security, Compliance, and Modernization Investments

ATM services revenue continues to grow as operators invest in:

- Anti-skimming technology

- Encryption and software upgrades

- EMV compliance

- Remote monitoring and fraud detection

In the United States, ATM counts declined from approximately 470,000 units in 2019 to 451,500 units in 2022, accelerating replacement and modernization cycles.

Source:Payments Dive

5. Adoption of Cash Recycling and Smart Cash Management

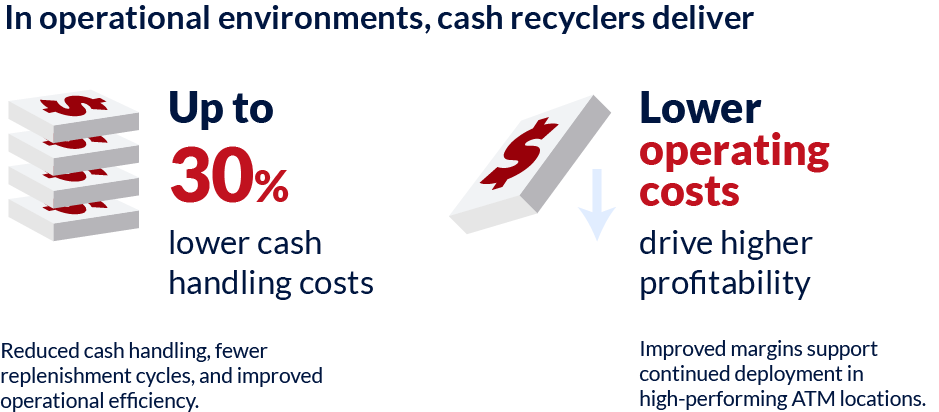

Cash recycler ATMs allow deposited cash to be reused for withdrawals, reducing cash handling frequency and overall operating costs.

Industry analysis indicates that cash recyclers can reduce cash handling costs by up to 30 percent in certain environments. Lower operating costs improve profitability and encourage continued deployment in high-performing locations.

U.S. ATM Services Market Segmentation

By Deployment Location

- On-site ATMs at bank branches and financial institutions

- Off-site ATMs in retail, hospitality, and travel locations

By Ownership Model

- Bank-owned ATMs

- Independent ATM deployers and managed service providers

Independent operators account for more than half of all ATMs in the United States.

By Service Type

- ATM installation and placement

- Cash replenishment and logistics

- Monitoring and maintenance

- Transaction processing

- Security and compliance services

Common Questions from Store Owners

How does an ATM generate revenue?

Revenue typically comes from surcharge fees, revenue-sharing agreements, or fixed monthly commissions. Earnings depend on transaction volume, location visibility, surcharge pricing, and uptime.

Will ATMs remain relevant through 2035?

Yes. While digital payments continue to grow, cash remains widely used in retail and hospitality environments. ATM services evolve alongside digital banking rather than being replaced by it.

Is hosting an ATM safe?

Modern ATMs include anti-skimming devices, encryption, remote monitoring, and insurance coverage through service providers. The risk to the location owner is significantly reduced when working with a reputable operator.

Should I choose surcharge-free or surcharge-based models?

Surcharge-based models typically generate higher revenue per transaction, while surcharge-free networks often deliver higher transaction volumes. The optimal choice depends on customer behavior and foot traffic.

Competitive Landscape Overview

The ATM services ecosystem includes:

- ATM hardware and software providers

- Independent ATM operators

- ATM networks

- Cash logistics companies

- Security and compliance vendors

Competition increasingly centers on service quality, uptime, compliance, and strategic retail placement rather than ATM quantity alone.

ATM Services Market Outlook (2026–2035)

Key trends expected over the next decade include:

- Increased reliance on managed ATM services

- Selective expansion of high-performing retail locations

- Continued modernization and compliance upgrades

- Wider adoption of cash recycling technology

- Growth through large-scale retail partnerships

Final Takeaway for U.S. Business Owners

Based on this ATM Services Market Growth Forecast, the global ATM services market is projected to reach USD 52.44 billion by 2035, growing at a 6.10 percent CAGR, while the U.S. market continues steady expansion supported by retail deployment and service-based revenue models.

Source:Expert Market Research

For store owners, gas station operators, supermarkets, and hotel managers, ATMs remain a proven way to increase customer convenience, capture on-site spending, and generate a reliable secondary income stream—especially when deployed through managed service models.

Included In This Story

ATM Link, Inc.

YOUR MAJOR RESOURCE FOR ATM PROCESSING, PRODUCTS, AND SERVICES

For over 26 years, ATM Link, Inc. has been helping retailers maximize profits with hassle-free ATM solutions. From transaction processing to full-service programs, quality ATMs, and expert support, we’ve got you covered nationwide. We prioritize customer satisfaction, security, and transparency, ensuring smooth operations and increased earnings

ChatGPT

ChatGPT Grok

Grok Perplexity

Perplexity Claude

Claude