Blog

Are you getting the most commission from your ATM? Find out today.

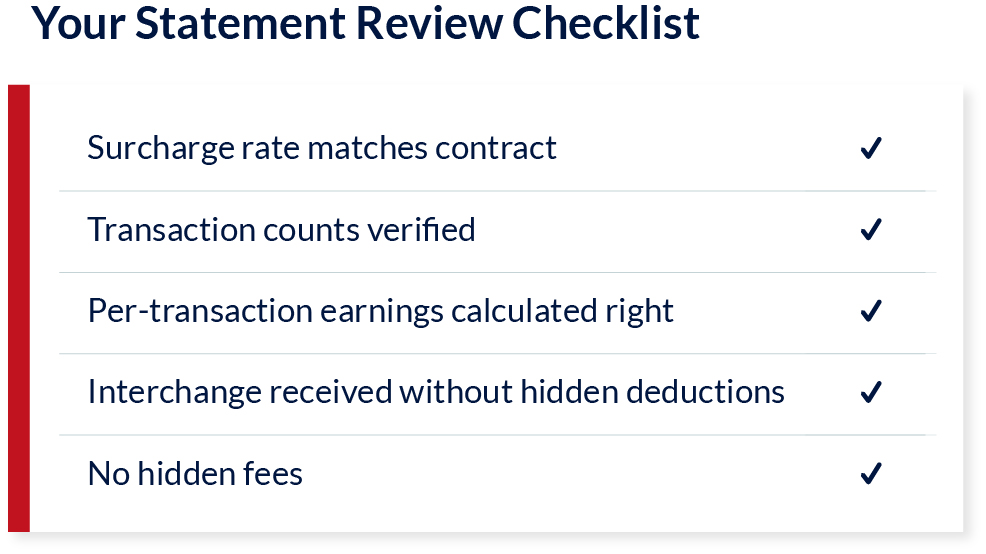

To maximize your ATM commission, regularly review your statement for accuracy. Verify surcharge rates, cross-check transaction volumes, calculate average commission per transaction, and ensure full interchange income without hidden deductions. Check for processing fees and demand clear, timely reports from your provider. Don’t miss out,schedule

July 9, 2025

Understanding your commission statement is the first step to unlocking steady profits, protecting your investment, and spotting opportunities others miss.

Whether you’re an ATM deployer, ISO, or a business owner hosting ATMs, this quick deep dive will show you how to review your statements the right way—and make sure you're not leaving money on the table.

Let’s break down the exact steps, common pitfalls to avoid, and key figures you need to know, so you can finally make the most of every dollar your ATM earns.

Why Your ATM Commission Statement Deserves a Closer Look, Now

For many ATM owners, especially in retail and hospitality, an ATM isn’t just a convenience; it’s a consistent source of revenue. Yet too often, the monthly commission statement gets overlooked, with important details buried in the fine print or not listed at all.

If you’ve ever asked yourself:

- How much should I be earning per transaction?

- Am I receiving all my surcharge and interchange income?

- Are there hidden deductions I'm not aware of?

…then this guide is for you. Let’s start by breaking down what your ATM commission statement includes.

What Is an ATM Commission Statement?

Your commission statement is a monthly or periodic report provided by your processor or ISO/IAD. It typically details:

- Total transactions (withdrawals, inquiries, denials, transfers)

- Total surcharged transactions

- Surcharge collected

- Interchange income (withdrawals, inquiries, denials, transfers)

- Your commission split

- Processing fees

- Monthly or administrative fees (if any)

If you're not carefully reviewing each of these, you could be missing hundreds or thousands of dollars annually.

But here’s a question: Do you even receive your ATM statement regularly?

Step-by-Step: How to Analyze Your ATM Commission Statement

1. Verify the Surcharge Setup

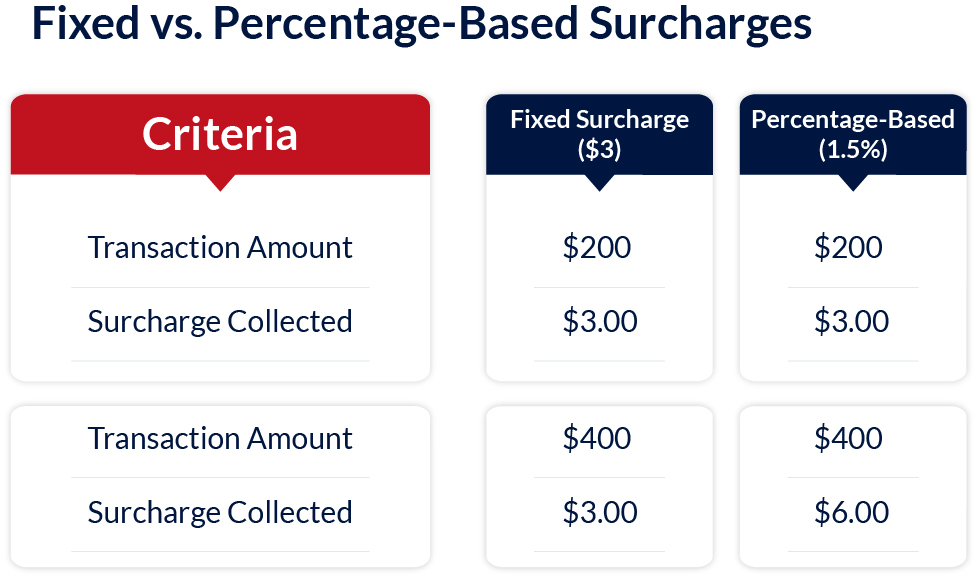

Begin by comparing the surcharge rate specified in your contract with the rate charged at your ATM.

- Perform a test withdrawal—ideally for an amount over $200—to check if any percentage-based surcharge is applied.

- If your agreement specifies a fixed surcharge (e.g., $3), but the ATM charges a variable rate (e.g., 1.5%), that’s a red flag.

Action: Contact your processor or ISO/IAD immediately. Misapplied surcharge rates mean you might be underpaidor misrepresented.

2. Cross-Check Transaction Volume

Access your ATM’s online reporting portal or on-site journal logs to track the actual number of completed transactions.

- Compare the transaction counts from the portal or logs with those reported on your commission statement.

- Look for discrepancies in valid surcharged withdrawals.

For example, if the portal shows 140 surcharged transactions but the statement reports only 125, investigate further. This could be due to an accounting delay or a data issue that needs resolution.

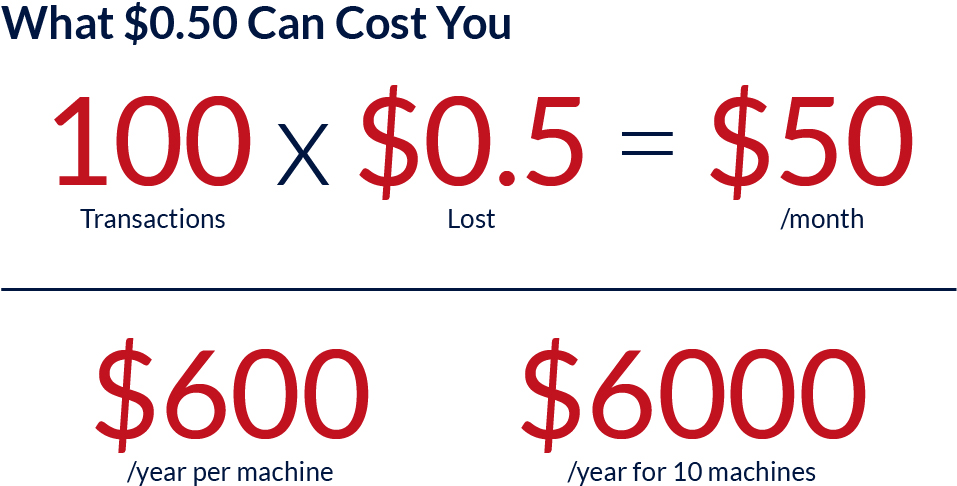

3. Calculate Your Average Surcharge Commission Per Valid Withdrawal Surcharged Transaction

Knowing your earnings per transaction gives you clarity and bargaining power.

Formula:

Total Surcharged Commission Earned ÷ Total Surcharged Transactions = Average Commission Per Transaction.

Let’s say you made $350 from 100 transactions:

- Your average: $3.50/valid withdrawal surcharged transaction

- If your contract states you should receive $3.50, so you’re good.

But if you're earning $3.00 instead? That’s $50 in lost surcharge revenue per month, and $600/year, per machine.

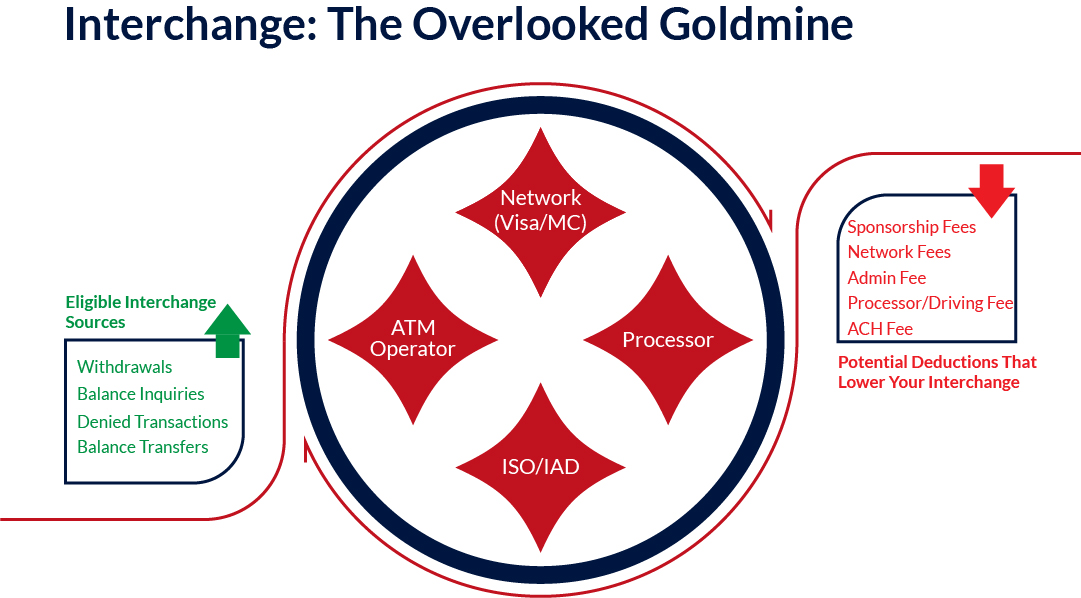

4. Understand Interchange Income (The Hidden Opportunity)

Most ATM owners focus on surcharge revenue, but interchange income is often overlooked.

Interchange is the fee paid by the processor and, depending on the processing arrangement—such as who owns the ATM and who loads it—this fee should be passed on in full to the ATM owner/operator. You should be receiving interchange on:

- Cash withdrawals

- Balance inquiries

- Balance transfers

- Denials (yes, even failed attempts can generate income!)

Important: The interchange passed on to you should not have hidden deductions like:

- Network fees

- Sponsorship fees

- Processing surcharges

- Administrative costs

5. Check for Processing & Hidden Fees

Review any fees that are deducted beforeyour payout hits your bank account:

- ACH Transfer Fees

- Monthly Hosting Fees

- Admin Charges

- Per-Transaction Processing Fees

Some providers subtract these quietly, reducing your actual commission without explanation.

If you’re noticing inconsistent payouts, these hidden charges are often the cause.

6. Ensure Your Commission Statement Is Clear and Transparent

An ideal commission statement should be:

- Detailed— Listing each fee and income source separately, not lumped together

- Timely— Delivered monthly on time, based on your agreement

- Accessible— Easy to access via an online portal or automatically emailed to you

- Consistent— Accurate with no unexplained errors or large variances

What to Expect from a Transparent ATM Provider

A reliable ATM provider or ISO/IAD doesn’t just pay you, they empower you. Here’s what your partner should offer:

Clear Data Access

You should have login access to real-time dashboards that show transactions, settlement history, and ATM health.

Clean, Understandable Reports

Your monthly statements should include:

- Surcharge revenue breakdown

- Interchange line item

- Clearly explained fee deductions

- Transaction counts by type

Timely Payouts

You should know:

- Howis it calculated?

- Whenwill your funds be received?

- Do you have the ability to dispute issues quickly if needed?

Get Control of Your Commission, Now

Many ATM owners treat their monthly statements like background noise. Don’t be one of them.. Reviewing your ATM commission statement monthly ensures you catch:

- Incorrect payouts

- Contract violations

- Hidden fees

- Opportunities to optimize your commission

Action Step:

Have your latest statement ready? We’ll review it with you, line by line,free of charge.

Schedule a Commission Review Now

Included In This Story

ATM Link, Inc.

YOUR MAJOR RESOURCE FOR ATM PROCESSING, PRODUCTS, AND SERVICES

For over 26 years, ATM Link, Inc. has been helping retailers maximize profits with hassle-free ATM solutions. From transaction processing to full-service programs, quality ATMs, and expert support, we’ve got you covered nationwide. We prioritize customer satisfaction, security, and transparency, ensuring smooth operations and increased earnings

ChatGPT

ChatGPT Grok

Grok Perplexity

Perplexity Claude

Claude